This twist has surprised many economists, especially those who criticized Trump’s trade policies.(photo-videograb)

TrumpTariffs Turn Into Unexpected Revenue Powerhouse

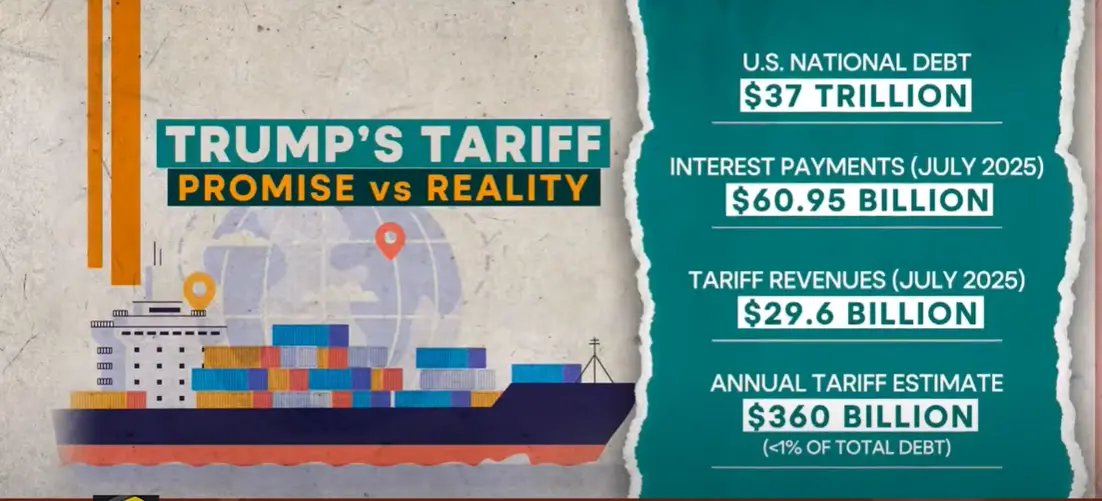

Trump Tariffs Now Boosting U.S. Debt Rating – In a surprising development, tariffs introduced during Donald Trump’s presidency are now playing a key role in supporting America’s debt rating. These tariffs, extra taxes placed on imported goods, were originally designed to protect U.S. industries and reduce trade deficits. But now, they’ve become a major source of government income.

According to recent reports, the revenue collected from these tariffs has grown so large that it’s helping the U.S. manage its national debt. This means the government is using tariff money to pay off loans and keep its credit rating stable. A strong debt rating helps the country borrow money at lower interest rates, which is important for funding public services and infrastructure.

This twist has surprised many economists, especially those who criticized Trump’s trade policies. While tariffs were expected to hurt trade and raise prices, they’re now being seen as a financial cushion for the U.S. economy.

How Tariffs Work and Why They Matter

Tariffs are taxes placed on goods that come from other countries. For example, if the U.S. puts a 25% tariff on steel from China, American companies have to pay extra to import that steel. The money goes to the U.S. government.

Trump’s administration introduced tariffs on countries like China, India, Mexico, and the European Union, targeting products such as steel, aluminum, electronics, and even household items. The goal was to make American-made products more competitive and reduce reliance on foreign goods.

While some businesses struggled with higher costs, the government collected billions of dollars in tariff revenue. Over time, this money added up and now it’s helping the U.S. deal with its massive national debt, which is over $34 trillion.

Debt Rating Explained: Why It Matters

A country’s debt rating is like a credit score. It tells investors how safe it is to lend money to that country. If the rating is high, the country can borrow money easily and at low interest rates. If the rating drops, borrowing becomes more expensive and risky.

Recently, credit rating agencies like Moody’s and Fitch have noted that tariff revenues are helping the U.S. maintain its rating. This is important because the U.S. government often borrows money to fund programs like healthcare, education, and defense.

Without strong revenue sources, the debt rating could fall, leading to higher costs and economic instability. So, even though tariffs were controversial, they’re now seen as a financial tool that’s keeping America’s economy afloat.

What This Means for the Future of Trade

This new role of tariffs raises big questions about the future of U.S. trade policy. Will future presidents continue using tariffs as a revenue source? Will other countries respond with their own tariffs?

Some experts warn that relying too much on tariffs could hurt global trade and lead to price hikes for consumers. Others argue that smart use of tariffs can protect local industries and strengthen national finances.

For now, Trump’s tariffs once seen as risky, are proving to be unexpectedly useful. Whether this trend continues depends on how the U.S. balances trade, diplomacy, and economic growth in the years ahead.

Final Thought: Tariffs were never meant to be a financial lifeline. But in today’s complex global economy, they’ve become just that. As America faces rising debt and global competition, Trump’s trade legacy may be remembered not just for its boldness but for its surprising impact on the nation’s financial health.

Also read – “Paper Tiger Economics?”: Top Economist Schiff Warns Trump Tariffs Could Cripple US Consumers

Stay updated with latest updated news blogs on Rapido Updates.