Empowering India: Unlocking Safety Through PM Suraksha Bima Yojana

India’s journey toward inclusive growth hinges not just on economic expansion but on ensuring that every citizen, especially the poor and vulnerable, has access to basic financial protection. One of the most impactful initiatives in this direction is the Pradhan Mantri Suraksha Bima Yojana (PMSBY), a low-cost accident insurance scheme that has quietly transformed the landscape of social security in India.

Let’s dive into how PMSBY bridges the gap between financial vulnerability and security, and why it’s a cornerstone of India’s financial inclusion mission.

1. Understanding PM Suraksha Bima Yojana: A Safety Net for All

Launched in May 2015, PMSBY is a government-backed accident insurance scheme aimed at providing affordable coverage to individuals, especially those from economically weaker sections.

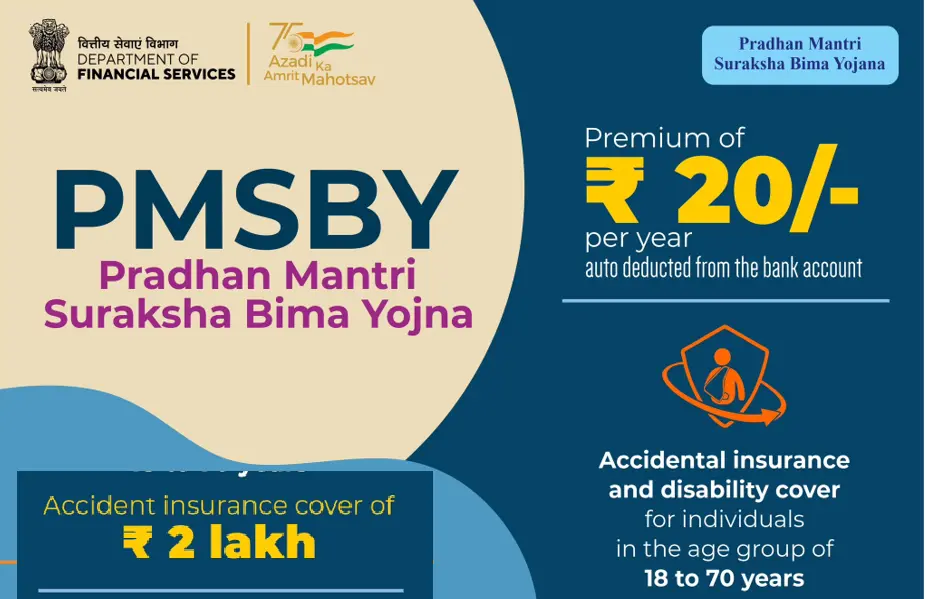

Key Features:

- Coverage Amount: ₹2 lakh for accidental death or total disability; ₹1 lakh for partial disability.

- Premium: Just ₹20 per annum.

- Eligibility: Any Indian citizen aged 18-70 with a bank account.

- Enrollment: Auto-debit from bank account, renewable annually.

This scheme is part of a broader financial inclusion strategy that includes Jan Dhan Yojana, PM Jeevan Jyoti Bima Yojana, and Atal Pension Yojana. Together, they form a triad of protection, life, accident and pension, for millions who previously had no access to formal insurance.

2. Financial Inclusion: More Than Just Bank Accounts

Financial inclusion isn’t just about opening bank accounts, it’s about enabling people to use financial services meaningfully. PMSBY plays a vital role in this by:

- Reducing vulnerability: A single accident can plunge a low-income family into debt. Pradhan Mantri Suraksha Bima Yojana offers a cushion.

- Encouraging savings: Knowing that insurance is linked to a bank account motivates people to maintain their accounts.

- Building trust: Government-backed schemes foster confidence in formal financial institutions.

- Empowering women and rural citizens: Many beneficiaries are first-time account holders, often women or rural workers.

By integrating insurance with banking, PMSBY ensures that financial inclusion is not just symbolic but functional.

3. Impact and Reach: Numbers That Tell a Story

Since its inception, PM Suraksha Bima Yojana has seen massive enrollment, especially among low-income and rural populations.

Highlights:

- Over 30 crore enrollments as of recent data.

- Claims worth ₹1,000+ crore disbursed, offering real relief to families.

- High penetration in states with large rural populations like Uttar Pradesh, Bihar, and West Bengal.

The scheme’s simplicity and affordability have made it a success story in public policy. It’s also a model for other developing nations seeking to expand social security coverage without overwhelming fiscal burdens.

4. Challenges and the Road Ahead

Despite its success, PMSBY faces several challenges:

- Awareness gaps: Many eligible citizens remain unaware of the scheme.

- Claim processing delays: Bureaucratic hurdles can slow down disbursement.

- Low renewal rates: Some users don’t renew due to lack of reminders or understanding.

- Limited coverage: ₹2 lakh may not be sufficient in severe cases.

What Can Be Done:

- Digital outreach: Use mobile apps and SMS to educate and remind users.

- Integration with Aadhaar: Streamline verification and claims.

- Increase coverage: Consider inflation-adjusted benefits.

- Community engagement: Leverage local leaders and NGOs to spread awareness.

The future of PMSBY lies in deepening its reach and enhancing its effectiveness, ensuring that no Indian is left unprotected due to lack of awareness or access.

Final Thoughts

PM Suraksha Bima Yojana is more than just an insurance scheme, it’s a symbol of inclusive governance. In a country where millions live on the edge of financial precarity, PMSBY offers a lifeline. It’s a quiet revolution, one ₹20 premium at a time.

As India continues to digitize and democratize its financial systems, schemes like PMSBY will be critical in ensuring that social security is not a privilege, but a right.

Here’s a complete guide on how to avail benefits and apply for the Pradhan Mantri Suraksha Bima Yojana, along with official resources:

5. How to Avail Benefits from PMSBY

To claim benefits under PMSBY in case of accidental death or disability:

- Nominee or insured person must contact the bank or post office where the policy is held.

- Submit the claim form, disability/death certificate, FIR or police report, and hospital records (if applicable).

- The insurance company will verify and process the claim through the bank/post office.

- Approved claims are paid directly to the nominee or insured’s account.

6. How to Apply for PMSBY

You can enroll in PMSBY through three convenient methods:

1. Via Bank Branch or Post Office

- Visit your bank or post office.

- Fill out the PMSBY enrollment form.

- Provide Aadhaar and account details.

- Give consent for auto-debit of ₹20 annual premium.

2. Via SMS

- If your bank supports SMS enrollment, you’ll receive a prompt.

- Reply with “PMSBY Y” to confirm.

- Premium will be auto-debited from your account.

3. Via Internet Banking

- Log in to your bank’s net banking portal.

- Navigate to the “Insurance” or “Social Security Schemes” section.

- Select PMSBY and confirm enrollment.

- Premium will be auto-debited annually.

7. Official Government Websites to Apply or Learn More

- Ministry of Finance – PMSBY Portal

Offers detailed scheme guidelines, eligibility, and claim process. - National Portal of India – PMSBY Page

Provides access to related schemes and downloadable forms.

Pradhan Mantri Jan Dhan Yojana -PMJDY: A Transformative Decade of Universal Banking Empowerment

2 thoughts on “Silent Revolution: PMSBY- Pradhan Mantri Suraksha Bima Yojana, The ₹20 Insurance That’s Reshaping Social Security in India”

Comments are closed.