- Relief for Taxpayers: ITR-2 Form Goes Live with Pre-Filled Ease

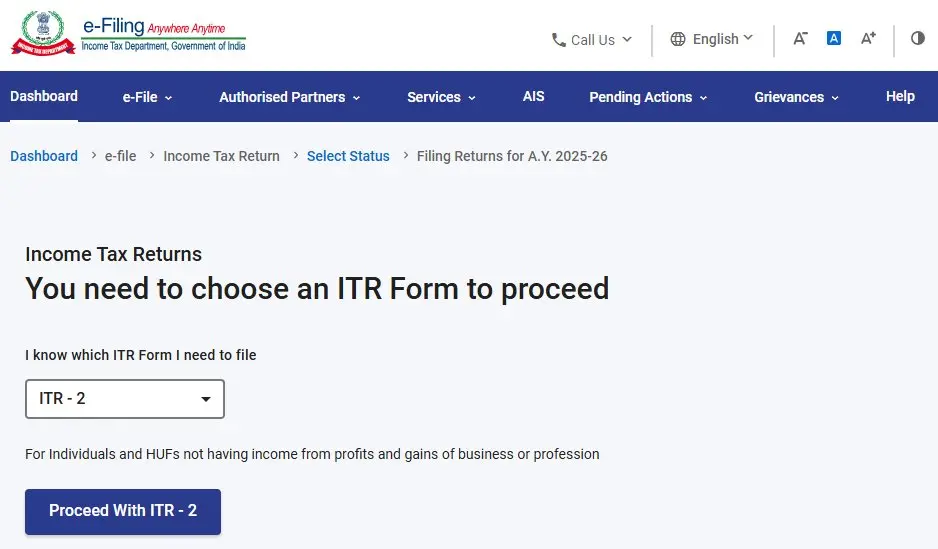

The Income Tax Department of India has officially activated the ITR-2 form for online filing for the Assessment Year 2025-26, bringing relief and clarity to millions of taxpayers. With pre-filled data now available on the e-filing portal, individuals and Hindu Undivided Families (HUFs) with income from capital gains, crypto assets, foreign sources, and multiple properties can file their returns more efficiently. But that’s not all Forms 3CA-3CD and 3CB-3CD have also been updated to reflect recent regulatory changes, streamlining the tax audit process for professionals and businesses.

Let’s break down what’s new, what’s changed, and how it affects you.

What Is ITR-2 and Who Should File It?

ITR-2 is applicable to:

- Individuals and HUFs not having income from business or profession

- Those with income from:

- Salary or pension

- Capital gains (short-term and long-term)

- Foreign assets or income

- More than one house property

- Dividends, crypto, or lottery winnings

It’s ideal for salaried professionals with investments, high-net-worth individuals, and anyone with complex income sources.

What’s New in ITR-2 for AY 2025-26?

The ITR-2 form has undergone six major updates to align with the Finance Act 2024 and improve compliance:

1. Capital Loss on Share Buybacks

- A new row in Schedule CG allows reporting of capital losses from share buybacks.

- These losses are now permitted if the corresponding dividend income is disclosed under ‘Income from Other Sources’.

2. Dividend Income Disclosure

- A separate field captures dividend income under Section 2(22)(f), specifically from share buybacks.

3. Real Estate Transfers

- Taxpayers must now bifurcate cost of acquisition and improvement for property transfers before and after 23 July 2024, enabling proper indexation.

4. Asset and Liability Reporting Threshold Raised

- The threshold for mandatory reporting has increased from ₹50 lakh to ₹1 crore, reducing compliance burden for middle-income taxpayers.

5. Capital Gains Segregation

- Due to revised tax rates effective 23 July 2024, capital gains must be reported separately based on the transaction date.

6. TDS Section Code Added

- A new column in Schedule TDS requires specifying the section under which tax was deducted, improving traceability and reconciliation.

Extended Filing Deadline

The deadline for filing ITR-2 has been extended to 15 September 2025, giving taxpayers more time to adapt to the new reporting requirements and validation rules.

Updates to Forms 3CA-3CD and 3CB-3CD

For businesses and professionals subject to tax audit under Section 44AB, the Income Tax Department has also rolled out updates to Forms 3CA-3CD and 3CB-3CD for FY 2024-25. Key changes include:

- Clause 8a: Now includes Section 115BAE for manufacturing co-operative societies.

- Clause 12: Requires reporting of presumptive income under Section 44ADA.

- Clause 18: Adjustments to written down value (WDV) under new tax regimes.

- Clause 21: Expanded reporting of expenses prohibited by law or incurred to compound offenses.

- Clause 32 & 34: Updated to reflect losses and TDS on online gaming winnings.

These changes aim to enhance transparency and ensure alignment with the latest tax provisions.

Filing Made Easier with Pre-Filled Data

The e-filing portal now supports:

- Pre-filled personal and financial data

- Auto-import from Form 26AS and AIS

- Validation rules to prevent errors

This reduces manual entry, speeds up the filing process, and minimizes mismatches that could trigger notices.

Tips for a Smooth Filing Experience

- Verify pre-filled data before submission.

- Use the correct ITR form – ITR-2 is not for business income.

- Report foreign assets and crypto income accurately.

- Consult a CA if you have complex capital gains or audit requirements.

- Don’t miss the deadline – late filing can attract penalties under Section 271B.

Final Thoughts as ITR-2 Goes Live

The activation of ITR-2 and the updates to audit forms mark a significant step toward a more streamlined and transparent tax filing experience. Whether you’re a salaried professional with stock investments or a taxpayer with foreign assets, these changes are designed to make compliance easier and more accurate.

As the tax season heats up, staying informed and filing early can save you time, stress, and money. The new ITR-2 form isn’t just a technical upgrade, it’s a reflection of India’s evolving tax landscape.

Stay updated with the latest news on Rapido Updates. Keep yourself updated with The World, India News, Entertainment, Market, Automobile, Gadgets, Sports, and many more

FAQ – Frequently Asked Questions

Who is eligible to file the ITR-2 form for AY 2025–26?

ITR-2 is meant for individuals and Hindu Undivided Families (HUFs) who do not earn income from business or profession but have income from salary, capital gains, more than one house property, foreign sources, dividends, or crypto transactions.

What new features are included in the updated ITR-2 form?

The ITR-2 for AY 2025-26 includes pre-filled data, refined capital gains reporting, separate disclosure for dividend income from buybacks, and new thresholds for asset/liability declarations. It also integrates updated validation logic to reduce filing errors.

Has the ITR-2 filing deadline been extended for this year?

Yes, the deadline has been extended to 15 September 2025, allowing more time for taxpayers to review pre-filled information and comply with recent changes in reporting formats.

Do I need to report crypto or digital asset income in the ITR-2?

Absolutely. If you’ve traded, earned, or received crypto assets or virtual digital assets during the financial year, the ITR-2 requires you to disclose gains under the relevant capital gains section.

2 thoughts on “ITR-2 Goes Live: A Welcome Boost for Taxpayers Navigating the New E-Filing Experience”

Comments are closed.