The BSE Sensex closed 91 points higher at 84,058 on July 1, 2025, as blue-chip stocks like Reliance and BEL led gains

Market Snapshot: Sensex Ends Higher, Nifty Holds 25,500

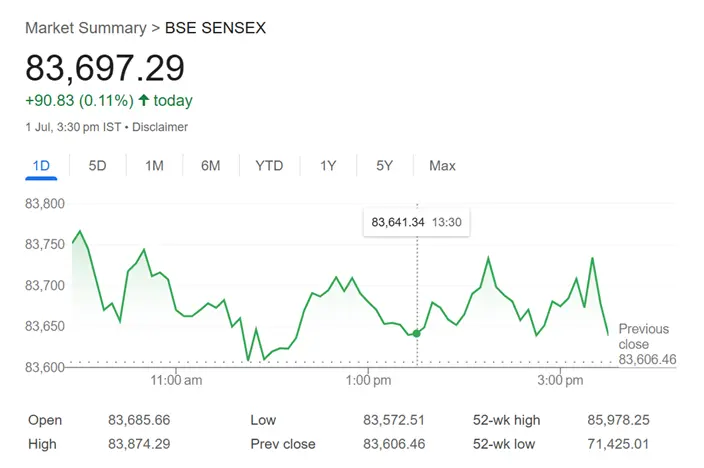

The Indian stock market kicked off July on a cautiously optimistic note. The BSE Sensex closed at 84,058.90, up 91 points (0.11%), while the Nifty 50 settled at 25,637.80, gaining 88.80 points (0.35%). This marks the continuation of a four-session winning streak, driven by strong buying in heavyweight stocks and renewed foreign institutional investor (FII) interest.

Key performers included:

- Reliance Industries, which surged over 2%, contributing significantly to the Sensex’s upward momentum

- Bharat Electronics Ltd (BEL), which also posted strong gains amid robust order inflows and defense sector optimism

- ICICI Bank, HDFC Bank, and L&T, which provided stability to the index

On the flip side, Hero MotoCorp and select IT stocks saw mild profit booking, capping broader gains.

Market breadth remained positive, with advancing stocks outnumbering decliners, and midcap and smallcap indices also ending in the green.

Global Cues and Domestic Drivers: What’s Fueling the Rally?

Despite lingering concerns over global inflation and geopolitical tensions, Indian equities have shown remarkable resilience. Analysts attribute this to a combination of strong domestic macroeconomic indicators, corporate earnings optimism, and robust retail participation.

Key domestic drivers include:

- GST collections for June 2025 came in at ₹1.82 lakh crore, indicating sustained consumption

- Manufacturing PMI remained in expansion territory, signaling industrial strength

- RBI’s dovish stance on interest rates has boosted liquidity and investor sentiment

Globally, while U.S. markets remained mixed due to uncertainty around Fed rate cuts, Asian peers like Nikkei and Hang Seng posted modest gains, offering a supportive backdrop.

Foreign investors, who had turned net sellers in May, have resumed buying in June and July, buoyed by India’s relative macroeconomic stability and earnings visibility.

What Lies Ahead: Technical Outlook and Investor Strategy

With the Sensex holding above the psychological 84,000 mark and Nifty comfortably above 25,500, technical analysts believe the market is poised for further upside, albeit with intermittent volatility.

Key resistance levels for Nifty are seen around 25,800-26,000, while support lies near 25,300. For Sensex, the next hurdle is 84,500, with strong support at 83,500.

Investment strategists advise:

- Staying invested in quality large-cap stocks, especially in banking, energy, and infrastructure

- Avoiding overexposure to high-beta sectors like IT and real estate until global cues stabilize

- Monitoring Q1 FY26 earnings, which will begin rolling out mid-July and could set the tone for the next leg of the rally

Retail investors are also encouraged to diversify portfolios and consider systematic investment plans (SIPs) to navigate short-term volatility.Conclusion:

The Sensex’s steady climb above 84,000 reflects more than just market momentum—it signals investor confidence in India’s economic trajectory. As global markets wobble, India’s equity landscape continues to offer a rare blend of growth, stability, and opportunity. Whether you’re a seasoned trader or a cautious investor, the message is clear: India’s bull run still has legs.

Stay updated with the latest news on Rapido Updates. Keep yourself updated with The World, India News, Entertainment, Market, Automobile, Gadgets, Sports, and many more