Adani’s ₹9.55 lakh crore comeback challenges Ambani for India’s richest title. Explore the 2025 billionaire boom, rising stars, and economic transformation.

Adani’s Billionaire Comeback: Rs 9.55 Lakh Crore and Counting

Published on:

Author: Rapido Updates

India’s Wealth Race Heats Up in 2025

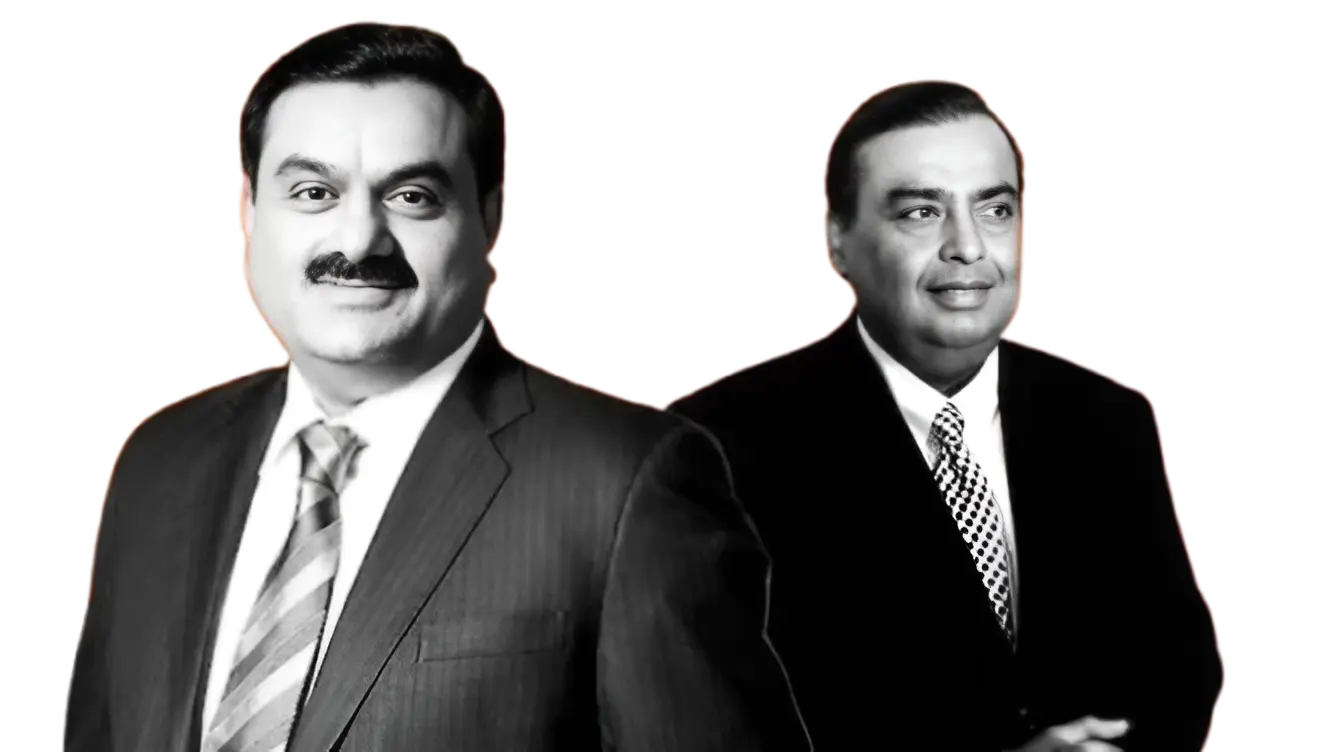

India’s billionaire landscape is witnessing a thrilling race at the top. According to the M3M Hurun India Rich List 2025, Gautam Adani’s net worth has surged to Rs 9.55 lakh crore, placing him neck-and-neck with Mukesh Ambani, who also holds Rs 9.55 lakh crore in wealth. This marks a dramatic comeback for Adani, who faced setbacks in previous years due to market volatility and regulatory scrutiny.

The Hurun report highlights that India now boasts over 358 billionaires, with a combined wealth of Rs 167 lakh crore—nearly half of the country’s GDP. The top two—Adani and Ambani—alone account for 12% of this staggering figure. Their rivalry is not just about numbers; it reflects two distinct visions of India’s industrial future—Ambani’s focus on consumer tech and telecom versus Adani’s infrastructure and energy empire.

Interestingly, the report also notes that the number of billionaires in India has grown by 84% over the past five years, signaling a robust entrepreneurial ecosystem and rising investor confidence. The wealth creation is not limited to metros—tier-2 cities like Surat, Indore, and Coimbatore are also producing new millionaires and billionaires.

Adani’s Meteoric Rise: What’s Driving the Surge?

Adani’s resurgence is powered by strategic expansions in energy, infrastructure, and green technology. His group’s aggressive investments in renewable energy and logistics have attracted global attention and investor confidence. In 2025, Adani’s wealth saw the largest absolute increase among Indian billionaires, adding nearly Rs 1 lakh crore.

Despite past controversies, Adani’s diversified portfolio and resilience have helped him bounce back. His companies are now key players in ports, airports, data centers, and solar energy, making him a symbol of India’s industrial ambition. The Adani Group’s recent partnerships with international firms in hydrogen energy and digital infrastructure have further boosted its valuation.

Experts believe that Adani’s ability to align his business interests with national priorities—such as clean energy and infrastructure development—has played a key role in his comeback. His strategic acquisitions, including stakes in media and cement, have also helped him expand influence across sectors.

India’s Billionaire Boom: Young Stars and New Entrants

The 2025 list isn’t just about legacy tycoons. Aravind Srinivas, 31, founder of AI startup Perplexity, became India’s youngest billionaire with Rs 21,190 crore. Meanwhile, Kaivalya Vohra (22) and Aadit Palicha (23) of Zepto continue to inspire as the youngest entrants. Their success stories reflect the power of innovation and digital disruption in India’s startup ecosystem.

Bollywood icon Shah Rukh Khan also made headlines by joining the billionaire club for the first time, with a net worth of Rs 12,490 crore. His diversified investments in entertainment, sports, and real estate have paid off handsomely. Khan’s entry into the list is a testament to the growing influence of celebrity entrepreneurs in India’s financial landscape.

Overall, the list includes 84 new entrants, many from emerging sectors like fintech, edtech, and healthtech. This signals a shift toward self-made wealth, with 66% of the list comprising entrepreneurs who built fortunes from scratch. The average age of billionaires has dropped to 65, showing that younger leaders are taking charge.

Women Billionaires Break Barriers

In a historic moment, Roshni Nadar Malhotra, chairperson of HCLTech, entered the top three with Rs 2.84 lakh crore, becoming India’s richest woman. The 2025 list features 101 women, including 26 dollar billionaires, signaling a growing presence of female entrepreneurs in India’s wealth ecosystem.

Roshni’s rise is attributed to strategic leadership and a significant stake transfer from her father, Shiv Nadar. Her success story is a beacon for aspiring women leaders across the country. Other notable women include Kiran Mazumdar-Shaw of Biocon and Falguni Nayar of Nykaa, who continue to redefine the role of women in business.

Interestingly, the report shows that women-led companies have outperformed the market average in terms of growth and sustainability. This trend is expected to accelerate as more women enter sectors like tech, finance, and manufacturing.

What This Means for India’s Economy

India’s billionaire boom is more than just headlines—it reflects the country’s evolving economic landscape. With wealth creators adding Rs 1,991 crore daily, the entrepreneurial spirit is thriving. Cities like Mumbai, Delhi, and Bengaluru remain hubs of innovation and investment.

Sector-wise, pharmaceuticals lead with 137 entrants, followed by industrial products and chemicals. This diversification shows that India’s growth isn’t limited to tech or traditional industries—it’s broad-based and resilient. The rise of billionaires in agriculture, logistics, and clean energy also points to a more inclusive economic future.

As Adani and Ambani continue their rivalry, the spotlight remains on India’s capacity to nurture wealth, innovation, and global influence. The 2025 Rich List is not just a ranking—it’s a reflection of India’s ambition and transformation. With supportive policies, digital infrastructure, and a young population, India is poised to become a global powerhouse of wealth creation.