The ETF market is shifting as newly launched funds break away from the Vanguard Effect, pushing fees to record highs

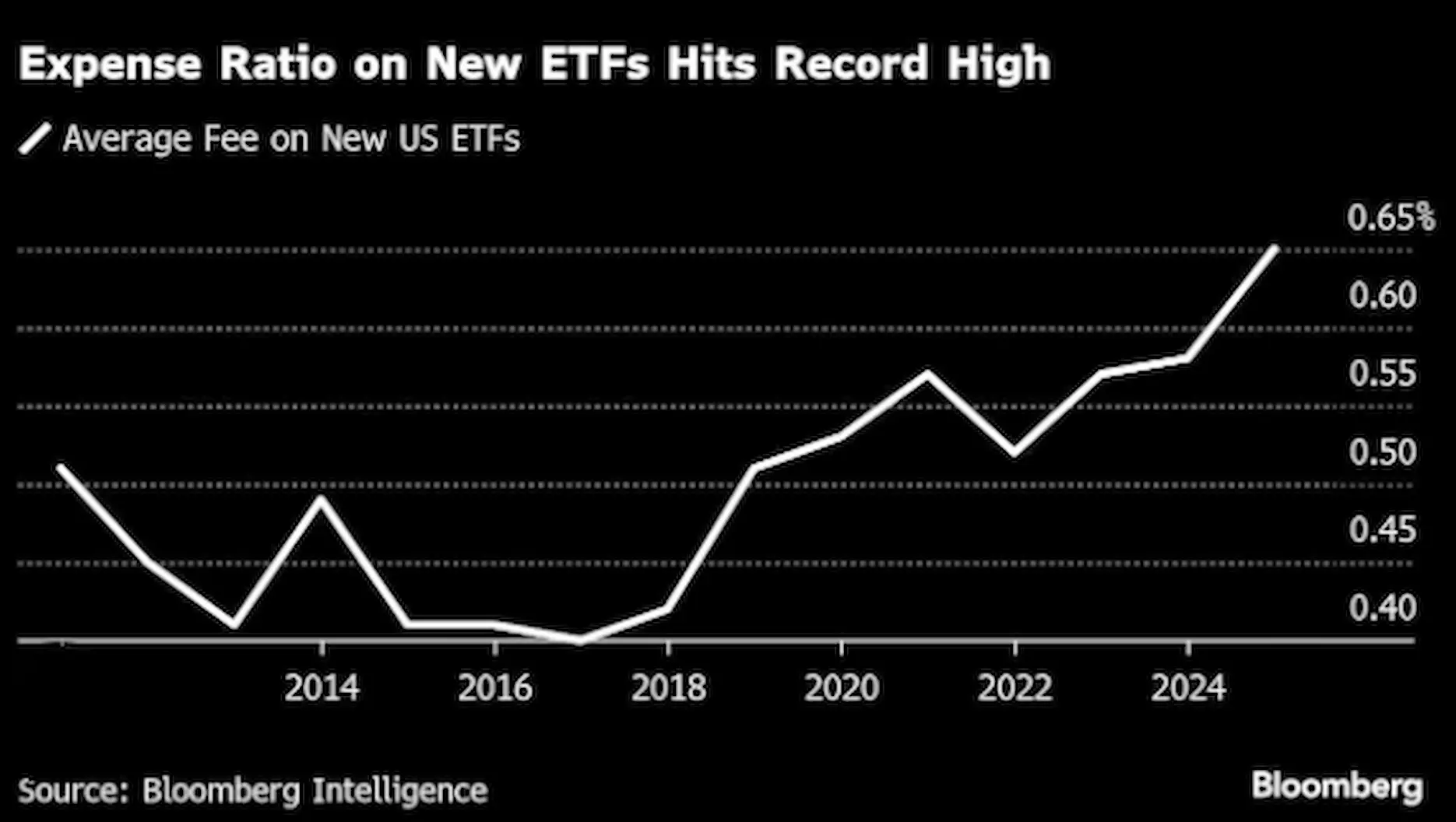

The world of exchange-traded funds (ETFs) is experiencing a dramatic shift. While legendary investor Jack Bogle envisioned a market dominated by low-cost index funds, the reality in 2025 is quite different. The latest wave of ETF launches has seen fees skyrocket to a record 65 basis points, marking a departure from the traditional Vanguard Effect that pushed costs lower.

With nearly 350 new ETFs introduced this year, many are embracing active management, cryptocurrency exposure, and leveraged trading, leading to higher expense ratios. This trend reflects a growing appetite for specialized investment strategies, even as core index funds remain inexpensive.

What Is the Vanguard Effect?

The Vanguard-Effect refers to the industry-wide push toward lower fees, driven by fund giants like Vanguard, BlackRock, and State Street. These firms have aggressively reduced expense ratios on their index-tracking ETFs, making passive investing more affordable for retail investors.

However, this cost-cutting trend has paradoxically enabled investors to allocate funds to more expensive, niche ETFs, fueling the rise of high-fee offerings.

Why Are ETF Fees Rising?

Several factors are contributing to the surge in ETF fees:

- Active Management: Many new ETF rely on active trading strategies, requiring higher fees to cover management costs.

- Leveraged & Crypto ETF: Funds offering 2x or 3x exposure to assets like GameStop (GME) and XRP cryptocurrency come with hefty expense ratios, some exceeding 1.5%.

- Specialized Investment Strategies: ETF focusing on catastrophe bonds, options trading, and niche sectors are commanding premium fees.

Despite the rise in costs, investors are willing to pay more for funds that offer unique exposure and higher potential returns.

Impact on Investors

For traders and long-term investors, the shift in ETF pricing presents both opportunities and challenges:

Pros:

Greater diversification through specialized ETF

Potential for higher returns in actively managed funds

Access to emerging sectors like crypto and leveraged trading

Cons:

Higher costs reduce overall portfolio gains

Increased risk in leveraged and speculative ETFs

Complex strategies may require deeper market knowledge

Investors must weigh the benefits of niche ETFs against the cost of higher fees, ensuring their portfolio aligns with their risk tolerance and financial goals.

Conclusion

The ETF market is evolving, with higher-fee funds gaining popularity despite the long-standing Vanguard-Effect. As investors seek specialized exposure, fund issuers are capitalizing on active management, leveraged trading, and niche strategies to drive profitability.

For traders, understanding the cost-benefit tradeoff is crucial. While low-cost index funds remain dominant, the rise of premium ETFs signals a new era in investment strategies.

Read – Salesforce Acquisition of Informatica for $8 Billion: A Game-Changer in AI-Driven Data Management

1 thought on “Newly Minted ETFs Defy Vanguard Effect as Fees Surge to Record Highs”