GST rate cut starts today: ghee, paneer, dry fruits, TVs, ACs now cheaper. A festive boost for families as India simplifies tax and slashes prices

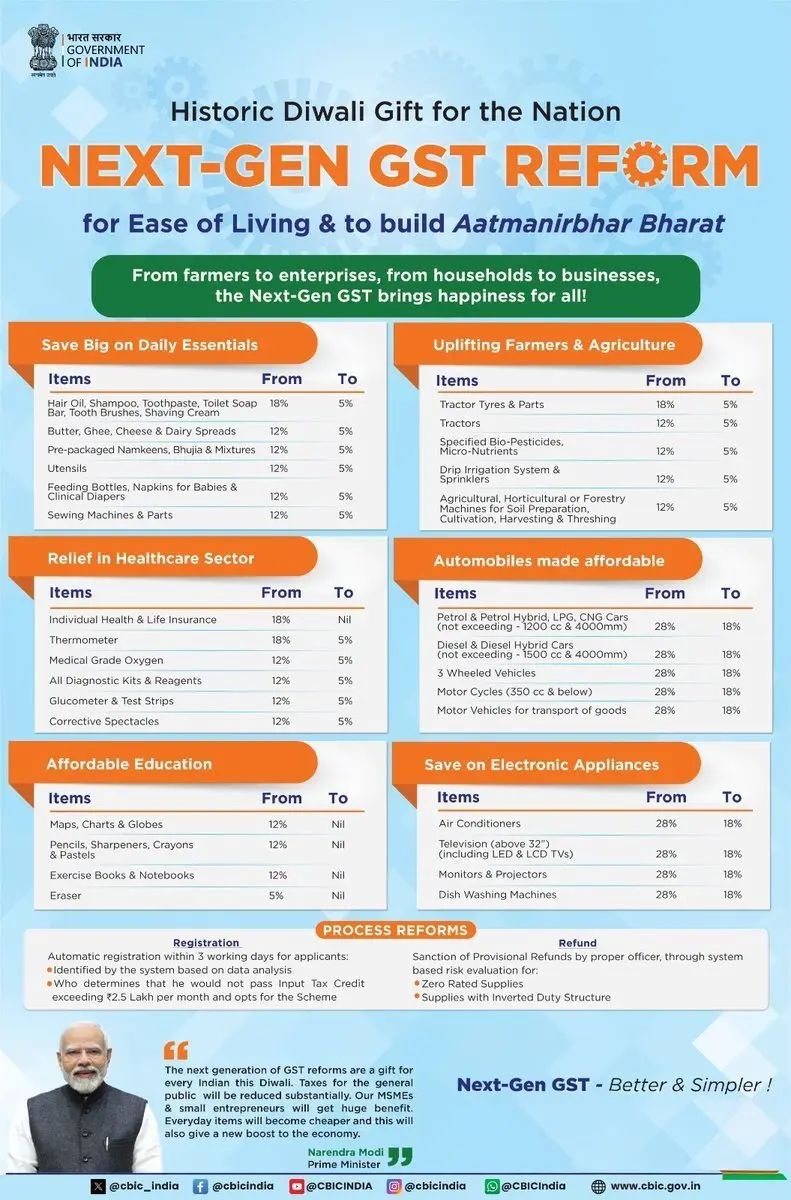

GST Rate Cut Brings Festive Relief for Every Indian Household – India’s biggest tax reform since 2017 has officially kicked in today, September 22, 2025, and it’s already being called a “GST Bachat Utsav” by Prime Minister Narendra Modi. With the start of Navratri, the government has rolled out sweeping changes to the Goods and Services Tax (GST) structure, slashing rates on over 375 items from kitchen staples and medicines to electronics and automobiles.

This move is expected to inject ₹2 lakh crore into the economy, reduce monthly expenses for millions of families, and boost consumer confidence ahead of the festive season. Let’s break down what’s changed, what’s cheaper, and how it affects you, in simple, easy-to-understand language.

Everyday Essentials Now Cost Less: What’s in Your Kitchen Basket?

If you’ve been watching prices inch up on your grocery bill, today’s GST rate cut brings welcome relief. A wide range of food items and personal care products have moved to the 5% or even 0% tax bracket.

Here’s what’s cheaper now:

Food & Kitchen Staples

- Ghee: Price cut of ₹40–70 per litre

- Paneer: ₹4 cheaper per 200g pack

- Butter, dry fruits, jam, ketchup, namkeen, bhujia, chocolates, ice cream

- Roti, parantha, khakra: Now attract 0% GST

Personal Care Products

- Hair oil, toilet soaps, shampoos, toothbrushes, toothpaste

- Talcum powder, face powder, shaving cream, after-shave lotion

Baby Essentials

- Diapers and feeding bottles

Stationery

- Notebooks, graph books, pencils, lab books: Now GST-free

These changes mean your monthly grocery and hygiene expenses could drop by 10–15%, depending on your consumption. FMCG brands like Amul and Mother Dairy have already announced price cuts on over 700 products.

Big Savings on Electronics and Appliances: TVs, ACs, Dishwashers

The GST Council has reduced rates on aspirational goods—items that many families save up for or buy during festivals. This includes electronics and home appliances that were previously taxed at 28%.

New GST Rates:

- Large TVs (above 32 inches): Now taxed at 18%, down from 28%

- Air Conditioners: Price drops of ₹2,800–₹5,900 on split units

- Dishwashers: Savings of up to ₹8,000

- Washing Machines, Refrigerators, Microwaves: All moved to 18% slab

Example Price Drops:

- 43-inch TV: ₹2,500–₹5,000 cheaper

- Premium 100-inch TV: ₹85,800 cheaper

This is a major win for middle-class families looking to upgrade their homes. Retailers are expected to roll out festive offers on top of the GST cuts, making this the best time to buy.

Cars, Bikes, and Travel: Mobility Gets More Affordable

The GST rate cut isn’t just about household goods, it also affects how you move. Automobiles and travel services have seen significant tax reductions, making mobility more accessible.

Automobiles:

- Small cars and two-wheelers (up to 350cc): GST reduced from 28% to 18%

- Auto parts, buses, trucks, and three-wheelers: Same reduction

- Big cars: Still taxed at 28%, but some luxury models now fall under the 40% sin goods bracket

Travel & Hospitality:

- Hotel rooms: GST reduced on most categories

- Packaged water (Rail Neer): ₹1 cheaper per bottle

These changes are expected to boost vehicle sales and domestic tourism. Brands like Maruti Suzuki have already announced revised price lists.

Health, Insurance, and Education: Relief for Families and Students

The GST reforms also touch sectors that directly impact your well-being and future, healthcare, insurance, and education.

Healthcare:

- 36 life-saving drugs for cancer, rare diseases, and cardiovascular conditions: Now GST-free

- Ayurveda, Unani, and other traditional medicines: Moved to 5% slab

- Medical devices like thermometers, glucometers, corrective goggles: Cheaper now

Insurance:

- Life and health insurance premiums: Now exempt from GST

Education:

- School and college stationery: No GST on notebooks, pencils, lab books

These changes make healthcare and education more affordable, especially for families with children or elderly members. It’s a step toward inclusive growth and better access to essential services.

Final Thoughts: A Reform That Touches Every Life

The GST rate cut is more than a policy tweak, it’s a festive gift to the nation. By simplifying the tax structure to just two slabs (5% and 18%), and introducing a special 40% rate for sin goods, the government has made taxation easier to understand and fairer to apply.

Prime Minister Modi called it a “double bonanza” when combined with recent income tax reliefs. Whether you’re buying groceries, upgrading your home, planning a trip, or investing in healthcare, this reform puts more money back in your pocket.

As the GST Bachat Utsav begins, one thing is clear: this Navratri, every Indian household has something to celebrate.

Also read: Modi’s GST Makeover: Cheaper Essentials, Simpler Taxes and a Diwali Gift for Every Indian

Stay informed with the latest news and updates – only on Rapido Updates.