New 5% and 18% slabs aim to boost affordability and growth ahead of Diwali

A Big Change in India’s Tax System

Modi’s GST Makeover: Cheaper Essentials, Simpler Taxes – On September 3, 2025, Prime Minister Narendra Modi announced a major change to India’s Goods and Services Tax (GST). The government has simplified the tax structure by reducing it to just two slabs: 5% and 18%, replacing the earlier four-tier system of 5%, 12%, 18%, and 28%. This new system will start from September 22, just in time for the festive season.

The goal is to make everyday items more affordable, help small businesses, and boost the economy. The reform is being called a “Next-Generation GST” and is seen as a Diwali gift to the people of India. It’s expected to reduce the cost of living and make it easier for businesses to follow tax rules.

What’s Getting Cheaper?

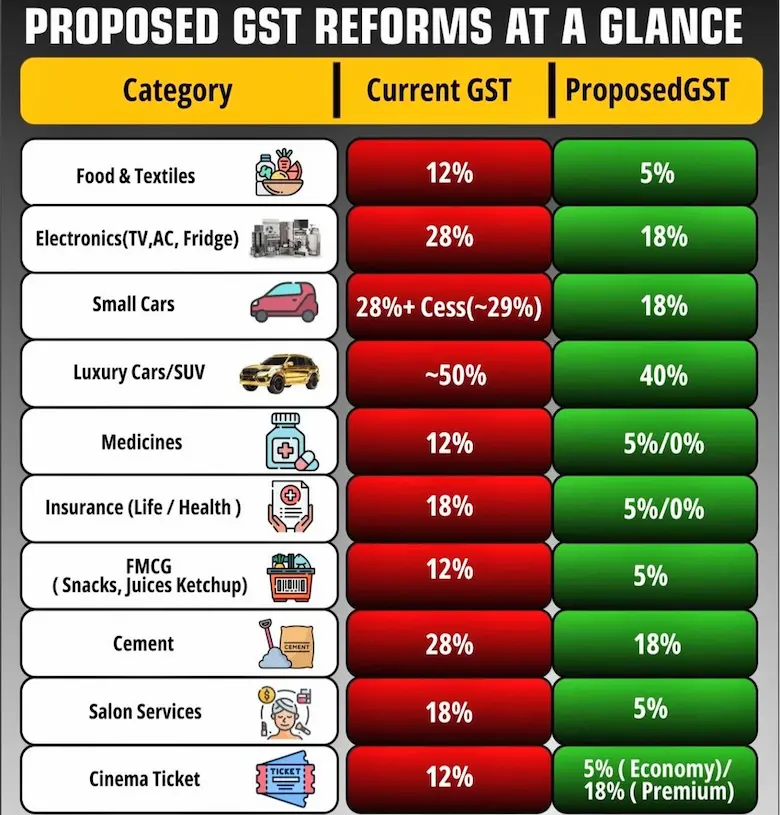

The new GST rates will make many essential items more affordable. Here are some of the key changes:

- From 18% to 5% GST:

Hair oil, shampoo, toothpaste, toilet soap, toothbrushes, shaving cream - From 12% to 5% GST:

Butter, ghee, cheese, dairy spreads, namkeens, bhujia, mixtures, utensils, feeding bottles, baby napkins, clinical diapers, sewing machines - Electronics:

Items like washing machines, refrigerators, and televisions will now fall under the 18% slab instead of 28%, making them cheaper - Books and Stationery:

School supplies and books will be taxed at 5%, helping students and parents - Automobiles:

Mid-range cars and two-wheelers will see reduced GST, making them more affordable for middle-class families - Insurance:

Life and health insurance are now fully exempt from GST, making protection more accessible

These changes are expected to boost consumption, especially during the festive season, and give relief to families struggling with rising costs.

Support for Farmers and Small Businesses

The GST reform is also designed to help farmers, MSMEs (Micro, Small and Medium Enterprises), and startups. Agricultural inputs like fertilizers, seeds, and equipment will now attract lower taxes, reducing the cost of farming.

Small businesses will benefit from:

- Simplified compliance: Fewer tax slabs mean easier filing and fewer errors

- Faster refunds: Automated systems will speed up GST refunds

- Pre-filled returns: Less paperwork and quicker processing

Finance Minister Nirmala Sitharaman said the reform will “ease the burden on households, farmers, and businesses” and make India’s tax system fairer and more predictable.

A Diwali Gift That Boosts the Economy

The timing of the GST reform is no coincidence. With Diwali approaching, the government hopes that lower prices will encourage people to spend more. This will help businesses grow and create jobs.

Experts believe the reform could increase India’s GDP growth by 0.2-0.3% in the short term. It also sends a strong signal to global investors that India is serious about making its economy more efficient and business-friendly.

Industry leaders like Anand Mahindra and Harsh Goenka have praised the move, calling it “transformative” and “a big Diwali gift for every Indian”. The reform is expected to help both urban and rural consumers, making it a win-win for the entire country.

Modi’s GST Reform Sparks Festive Cheer, But Will It Deliver Long-Term Relief?

Prime Minister Modi’s simplified GST reform is expected to receive a highly positive response across India. By reducing tax slabs to just 5% and 18%, the government has made the system easier to understand and more transparent for both consumers and businesses. The reduction in rates on essentials like milk, books, and electronics will directly benefit middle-class families, while exemptions on life and health insurance offer much-needed financial relief. Farmers and small businesses stand to gain from lower input costs and streamlined compliance.

With Diwali around the corner, the timing couldn’t be better, this reform is likely to boost festive spending, revive consumer confidence, and stimulate economic growth. Industry leaders have welcomed the move, and citizens are hopeful that this will lead to long-term affordability and fairness in taxation. Overall, the GST overhaul reflects a people-first approach and marks a significant step toward a more inclusive and efficient economy.

Also read – GST 2.0: India Tax Revolution Sparks Reform and Triggers Political Fire

GST Shake-Up Ahead: India Eyes 12% Slab Elimination to Simplify Tax Maze

Stay informed with the latest news and updates – only on Rapido Updates.

2 thoughts on “Modi’s GST Makeover: Cheaper Essentials, Simpler Taxes and a Diwali Gift for Every Indian”

Comments are closed.