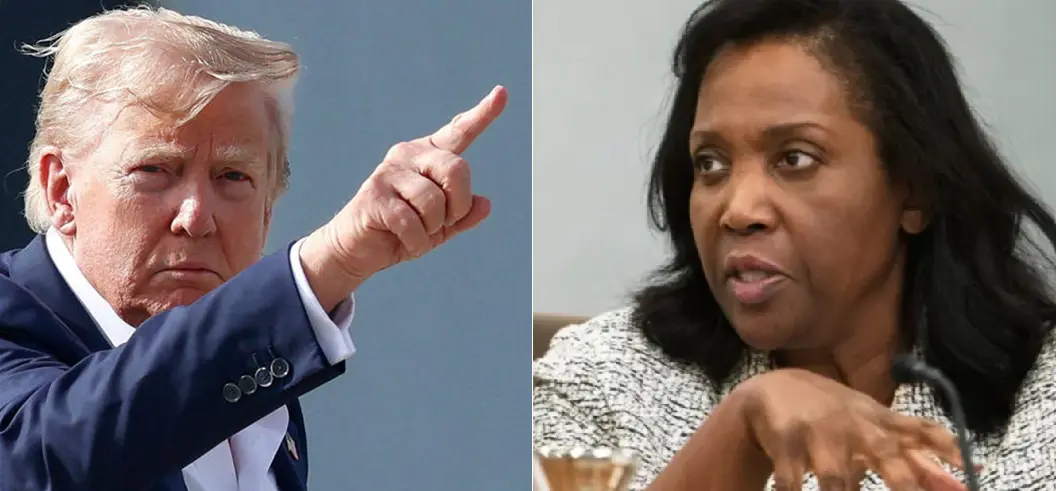

Trump demands Fed Governor Lisa Cook resign over mortgage fraud allegations

“Cook Must Resign!”- Explosive Allegations – In a dramatic escalation of political pressure on the Federal Reserve, President Donald Trump has publicly demanded the resignation of Governor Lisa Cook following allegations of mortgage fraud. The controversy, fuelled by a criminal referral from Federal Housing Finance Agency Director William Pulte, has ignited fresh debate over central bank independence, racial bias, and partisan warfare.

Table of Contents

The Allegations: Dual Residences, Dual Trouble

At the heart of the scandal are two properties, one in Ann Arbor, Michigan, and another in Atlanta, Georgia, allegedly designated by Cook as her “primary residence” within weeks of each other in 2021. According to Pulte, this dual declaration may have enabled Cook to secure favourable loan terms reserved for primary residences, potentially violating federal mortgage laws.

Pulte, a Trump appointee and vocal critic of the Fed’s monetary policy, posted the allegations on X (formerly Twitter), along with a letter to Attorney General Pam Bondi urging a criminal investigation. “It’s all there in black and white,” Pulte told CNBC, insisting the issue transcends party lines. “This isn’t political, it’s about integrity in our financial system.”

Cook, a Biden appointee and the first Black woman to serve on the Fed’s Board of Governors, has not publicly responded. The Federal Reserve has declined to comment, citing the ongoing review by the Department of Justice.

Political Undercurrents: Fed Independence Under Siege

Trump’s demand “Cook must resign, now!!!”, posted on Truth Social, is more than a call for accountability. It’s part of a broader campaign to reshape the Federal Reserve’s leadership and policy direction. With only two of the seven board members appointed by Trump, the former president has repeatedly criticized Chair Jerome Powell and pushed for aggressive interest rate cuts.

The timing is strategic. Cook’s term extends beyond Trump’s current presidency, complicating his efforts to install a majority on the Fed’s board. The recent resignation of Governor Adriana Kugler opened one seat, which Trump has already moved to fill with Stephen Miran, his top economic adviser.

Critics argue that Trump’s actions risk politicizing the Fed, a body traditionally insulated from partisan influence. Supporters counter that accountability should not be sacrificed at the altar of independence, especially when allegations of fraud are involved.

Racial and Partisan Fault Lines: A Deeper Divide

The case has also reignited concerns about racial and partisan targeting. Cook’s historic appointment was hailed as a milestone for diversity in economic policymaking. Her academic credentials and advocacy for inclusive growth made her a symbol of progress within the Fed.

Now, some observers fear the allegations are being weaponized to undermine that progress. “This feels like a coordinated effort to discredit a Black woman in power,” said one anonymous Fed staffer quoted by Reuters. Others caution against rushing to judgment, emphasizing the need for a fair and transparent investigation.

The racial undertone is hard to ignore, especially given the polarized political climate. Cook’s defenders argue that the scrutiny she faces is disproportionate compared to past controversies involving white male officials. The DOJ’s handling of the case will be closely watched not just for legal outcomes, but for its broader implications on equity and governance.

What’s Next: Legal Review, Political Fallout, and Fed Credibility

As the Department of Justice reviews the criminal referral, the stakes are high. If Cook is found to have violated mortgage laws, she could face penalties ranging from fines to removal from office. If cleared, the episode may still leave a lasting scar on the Fed’s reputation and internal cohesion.

Meanwhile, Trump’s campaign to reshape the Fed continues. With Powell’s term as Chair ending in May, Trump could nominate a new leader, potentially accelerating his push for looser monetary policy and greater executive influence over the central bank.

For now, the Fed remains silent. But silence may not be sustainable as pressure mounts from both political camps, media scrutiny intensifies, and public trust hangs in the balance.

Final Thought: Whether this scandal proves to be a legal breach or a political manoeuvre, it underscores the fragile balance between independence and accountability in America’s most powerful financial institution. As the investigation unfolds, the Fed’s credibility and its future may be on trial.

Also read – The $600B Ultimatum: How Trump Cornered Apple- His Ruthless Ultimatum