Masterstroke or Mayhem? Trump’s $600B Apple Deal Redefines Tech Diplomacy

Shockwaves in Silicon Valley: A Deal That Defied Expectations

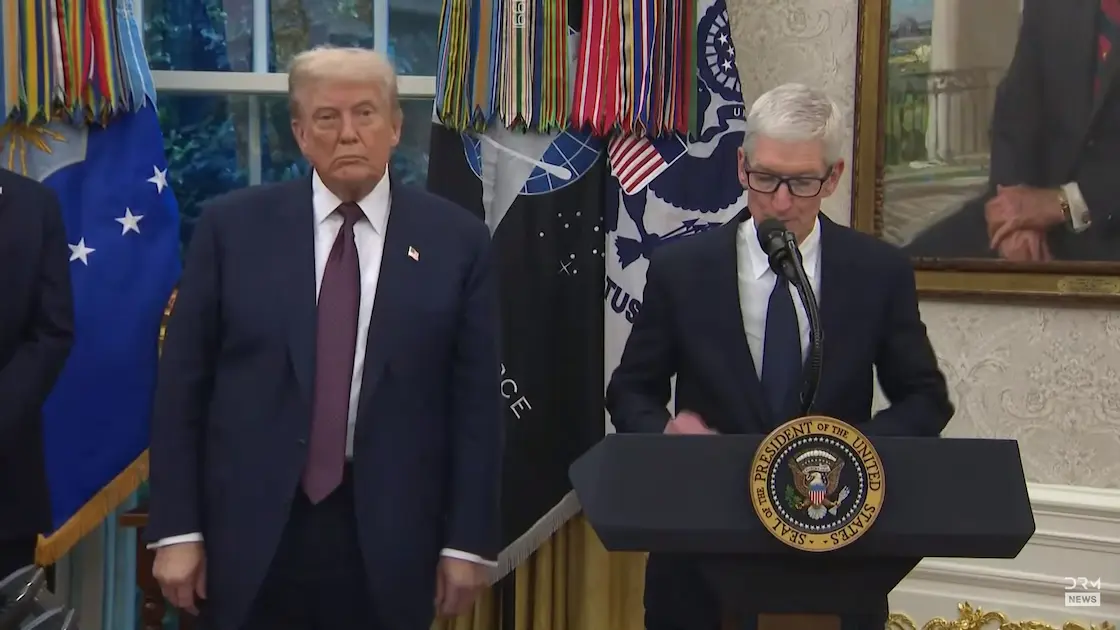

How Trump Cornered Apple – In a stunning turn of events, former President Donald Trump reportedly orchestrated a $600 billion strategic shift involving Apple, one of the world’s most valuable companies. The move, allegedly finalized in just two days, has sent shockwaves through Wall Street, Silicon Valley, and global tech circles.

According to insiders, the catalyst was a high-stakes meeting between Trump and Apple CEO Tim Cook. The agenda? A blunt ultimatum: realign Apple’s manufacturing and data infrastructure or face sweeping regulatory and trade consequences. Sources close to the negotiation describe the encounter as “tense but decisive,” with Trump leveraging geopolitical pressure and economic incentives to push Apple toward a dramatic pivot.

While the exact nature of the $600B shift remains under wraps, analysts speculate it involves a combination of divestments, supply chain restructuring, and capital reallocation, potentially impacting Apple’s operations in China, its investment in AI, and its future product roadmap.

Trump’s Leverage: National Security Meets Economic Muscle

Trump’s influence over Apple may seem surprising, but it’s rooted in a broader strategy he championed during his presidency: economic nationalism. His administration frequently targeted tech giants, urging them to bring manufacturing back to the U.S., reduce reliance on Chinese components, and align with national security priorities.

In this case, Trump reportedly framed the ultimatum as a patriotic imperative. With rising tensions over data privacy, AI dominance, and semiconductor supply chains, Apple was positioned as both a symbol and a strategic asset. The message was clear: adapt or be exposed.

Key leverage points included:

- Tariff Threats: Trump hinted at new tariffs on Apple products manufactured overseas.

- Antitrust Pressure: Regulatory scrutiny could intensify if Apple didn’t cooperate.

- Federal Incentives: Billions in tax breaks and infrastructure support were offered for domestic expansion.

Tim Cook, known for his diplomatic finesse, faced a rare moment of immovable force. The result? A reluctant but calculated agreement that could reshape Apple’s global footprint.

The Fallout: Market Jitters and Strategic Repositioning

News of the $600B shift triggered immediate market reactions. Apple’s stock dipped 4% in early trading, with investors scrambling to understand the implications. Analysts warned that such a massive reallocation could disrupt supply chains, delay product launches, and strain international partnerships.

However, some viewed the move as a long-overdue correction. Apple’s dependence on Chinese manufacturing has long been a vulnerability, especially amid rising geopolitical tensions. By diversifying its operations and aligning more closely with U.S. policy, Apple may gain long-term resilience, even if short-term turbulence is inevitable.

Potential areas of impact include:

- China Exit Strategy: Gradual withdrawal from key Chinese suppliers.

- U.S. Manufacturing Surge: Expansion of domestic chip production and assembly plants.

- AI and Data Sovereignty: Shifting cloud infrastructure to U.S.-based servers.

The $600B figure isn’t just symbolic, it represents a tectonic shift in how Apple allocates its capital, prioritizes its partnerships, and positions itself in a volatile global landscape.

Behind Closed Doors: What Really Happened in That Meeting

While official details remain scarce, leaks from insiders paint a vivid picture of the Trump – Cook meeting. Held in a secure location with minimal staff, the conversation reportedly lasted over three hours and involved classified briefings, economic forecasts, and strategic modelling.

Trump, known for his transactional style, reportedly opened with a blunt assessment: “Apple is too big to be neutral.” He then laid out a roadmap for how the company could become a cornerstone of American tech sovereignty. Cook, initially resistant, raised concerns about cost, logistics, and international fallout. But as the conversation progressed, the tone shifted.

One insider described the moment of agreement as “a handshake that felt like history.” Whether driven by pressure, pragmatism, or patriotism, Cook agreed to initiate the $600B shift, marking one of the most consequential corporate decisions in recent memory.

How Trump Cornered Apple: A New Era for Apple and American Tech

The alleged $600B ultimatum is more than a headline, it’s a turning point. If true, it signals a new era where tech giants are no longer just market players but geopolitical actors. Trump’s manoeuvre, whether viewed as bold leadership or coercive overreach, has forced Apple to confront its global dependencies and redefine its strategic priorities.

For consumers, investors, and policymakers, the ripple effects will be felt for years. And for Tim Cook, the decision may be remembered as the moment Apple chose national alignment over global neutrality.

Apple Inc Strategic Showdown: The Fierce Battle Between Efficiency and Autonomy

Stay updated with latest updated news blogs on Rapido Updates.

1 thought on “The $600B Ultimatum: How Trump Cornered Apple- His Ruthless Ultimatum”

Comments are closed.