Apple Q3 Earning - Apple looks ahead to Q4 and beyond, its ability to adapt, innovate and lead will be crucial

Apple Q3 Earning – Apple has once again defied expectations. In its fiscal third quarter ending June 2025, the tech titan posted a record-breaking profit of $23.4 billion, riding high on soaring iPhone sales, robust services growth, and resilient global demand, all while navigating the choppy waters of tariff headwinds and geopolitical uncertainty.

This blog unpacks Apple Q3 earning report, explores the strategic pivots behind its success, and analyses what this means for the company’s future in an increasingly volatile global market.

x The Numbers: A Snapshot of Success

Apple Q3 earnings of 2025 blew past Wall Street forecasts, with key figures including:

| Metric | Q3 2025 Result | Year-over-Year Change |

| Revenue | $94.0 billion | +10% |

| Net Profit | $23.4 billion | +9% |

| Earnings Per Share (EPS) | $1.57 | Up from $1.40 |

| iPhone Revenue | $44.6 billion | +13% |

| Services Revenue | $27.42 billion | +13% |

| Mac Revenue | $8.05 billion | +15% |

| iPad Revenue | $6.58 billion | -8% |

| Wearables & Home | $7.3 billion | Slight increase |

| Gross Margin | 46.2% | Boosted by Services |

Apple’s performance was particularly impressive given the $800 million tariff-related expenses it absorbed during the quarter.

iPhone 16: The Star of the Show

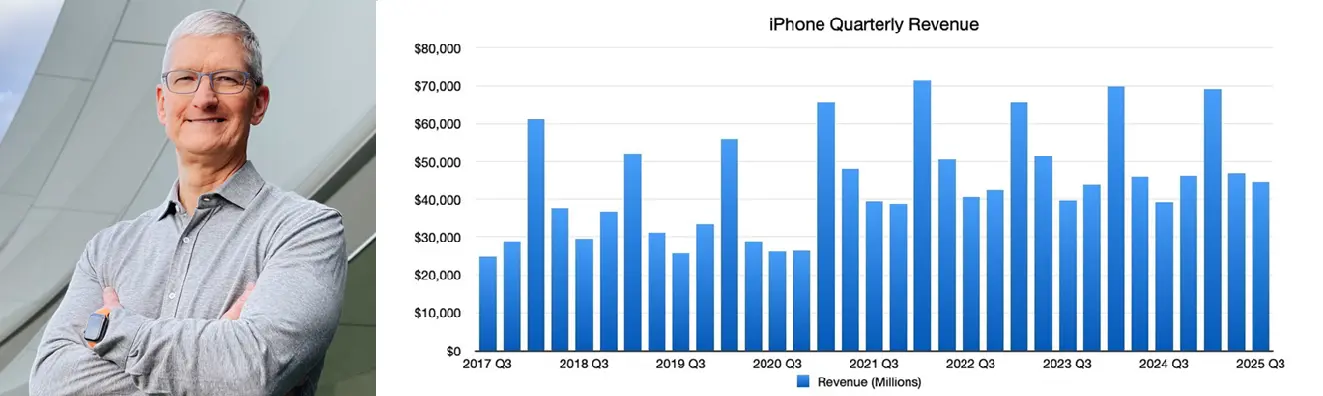

The iPhone continues to be Apple’s crown jewel. Q3 saw a 13% jump in iPhone revenue, driven by strong demand for the iPhone 16 Pro Max, higher average selling prices, and consumers rushing to buy ahead of potential tariff-driven price hikes.

Apple shipped 44.8 million iPhones, slightly down from last year, but revenue surged thanks to premium models and strategic inventory planning. Notably:

- China sales rose to $15.4 billion, up from $14.7 billion

- India production ramped up, helping offset tariff exposure

- Apple crossed the milestone of 3 billion iPhones shipped since 2007

CEO Tim Cook credited the iPhone’s resilience amid fierce competition and inventory corrections in the U.S..

Services Boom: The Quiet Powerhouse

Apple’s Services segment, which includes the App Store, Apple TV+, Apple Music, and iCloud+, delivered an all-time record of $27.42 billion, up 13% year-over-year.

Highlights include:

- 1.25 billion paid subscriptions, up 150 million in 12 months

- Apple Pay daily transactions doubled year-over-year

- Gross margin for Services hit 72%, shielding Apple from hardware cycles

This segment is now Apple’s most profitable, and a strategic focal point for Wall Street.

Mac and iPad: Mixed Signals

Apple’s Mac division rebounded with $8.05 billion in revenue, up 15%, thanks to the launch of M4-powered MacBook Air and MacBook Pro models. Educational and creative markets drove demand, and trade-in programs helped lower entry costs.

However, iPad revenue fell 8% to $6.58 billion, reflecting muted tablet demand and market saturation.

Navigating Tariff Headwinds

Apple’s Q3 success came despite significant tariff challenges:

- $800 million in tariff-related costs absorbed in Q3

- Expected $1.1 billion hit in Q4 due to new U.S. duties on China and India

- Strategic shift toward India-based production to mitigate exposure

Cook emphasized Apple’s flexibility in supplier sourcing and inventory planning, noting that most iPhones sold in the U.S. will soon come from India.

AI Investments: Betting on the Future

Apple is going all-in on artificial intelligence, pledging to “significantly” increase investments in generative AI and personalized Siri features. Key developments include:

- Reallocation of staff to AI efforts

- Potential acquisitions to accelerate roadmap

- Focus on privacy-centric, deeply integrated AI in iOS

Cook hinted at a more personalized Siri coming in 2026, with features like live translation and “workout buddies” on the horizon.

Shareholder Rewards and Cash Reserves

Apple ended the quarter with $159 billion in cash, after spending $20 billion on buybacks and dividends. This reflects continued confidence in its long-term growth and commitment to shareholder value.

Global Market Dynamics

Despite global smartphone shipments falling to 288.9 million units, Apple held strong:

- Finished second behind Samsung, with a 2% dip in shipments

- Maintained premium pricing and brand loyalty

- Navigated China competition and U.S. inventory corrections with agility

Apple’s performance underscores its ability to thrive in a volatile market, leveraging brand strength and strategic pivots.

Apple Q3 Earning of 2025 : Apple’s Balancing Act

Apple Q3 earning of 2025 are a masterclass in strategic resilience. By balancing hardware innovation, services expansion, and geopolitical navigation, the company has not only weathered tariff storms but emerged stronger.

Key takeaways:

- iPhone 16 demand remains robust, even amid global headwinds

- Services are now Apple’s most powerful growth engine

- AI investments signal a bold future beyond devices

- Tariff challenges are real, but Apple’s global footprint offers flexibility

As Apple looks ahead to Q4 and beyond, its ability to adapt, innovate, and lead will be crucial. Whether it’s reshaping Siri, expanding in India, or redefining digital services, one thing is clear: Apple isn’t just surviving, it’s setting the pace.

Also read –

Apple Inc Strategic Showdown: The Fierce Battle Between Efficiency and Autonomy

Foxconn’s Strategic Exodus: China’s Grip Jeopardizes Apple’s Bold Manufacturing Bet in India

Apple’s Bold Price Cut iPhone 16 Becomes the Smartest Buy Before iPhone 17 Hits the Market

Apple Boldest Redesign Yet Sparks Global Buzz: iPhone 17 Series Unleashed

iPhone 17 Air: Apple’s Ultra-Thin Marvel Set to Redefine Smartphone Elegance