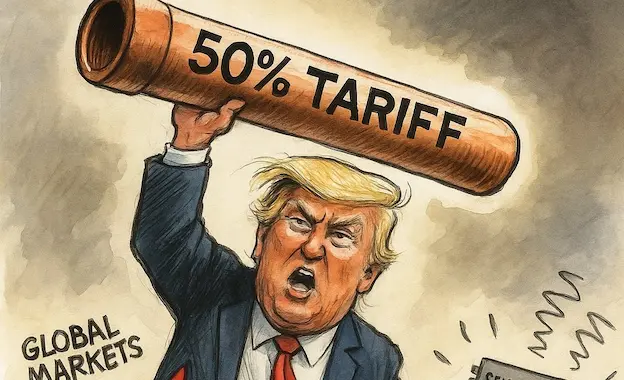

Trump announces a 50% tariff on copper imports, sending shockwaves through key industries like EVs, construction, and defense

The Announcement: Trump’s Tariff Gambit Hits Copper

Industry Panic – During a high-stakes Cabinet meeting on July 8, 2025, President Trump declared his administration would impose a 50% tariff on copper imports, marking one of the most aggressive commodity-specific trade actions in recent history. The announcement came earlier than expected and at a steeper rate than industry analysts had predicted.

Commerce Secretary Howard Lutnick confirmed that the tariff would be implemented by August 1, 2025, following the conclusion of a Section 232 national security investigation into copper imports. The rationale? To “bring copper home” and reduce reliance on foreign suppliers, particularly in strategic sectors like electric vehicles, military hardware, and renewable energy infrastructure.

The U.S. currently imports nearly half of its copper supply, with top sources including Chile, Canada, and Mexico. The tariff is expected to disrupt these supply chains and reshape sourcing strategies for manufacturers.

Industry Impact: Who Wins, Who Loses?

The ripple effects of the copper tariff are already being felt across multiple industries:

Electric Vehicles (EVs)

Copper is essential for EV batteries, motors, and charging infrastructure. A 50% tariff could:

- Increase production costs

- Slow down EV adoption

- Pressure automakers to localize supply chains

Construction & Power Grid

Copper wiring and tubing are foundational to residential and commercial construction, as well as power transmission. The tariff may:

- Drive up building costs

- Delay infrastructure projects

- Strain budgets for renewable energy expansion

Electronics & Consumer Goods

From smartphones to refrigerators, copper is a key component. Manufacturers may:

- Pass costs to consumers

- Seek alternative materials

- Reconfigure global sourcing

Defense & Aerospace

Military equipment relies heavily on copper for wiring and electronics. The tariff could:

- Inflate procurement budgets

- Delay defense contracts

- Trigger calls for domestic mining expansion

Meanwhile, domestic copper producers like Freeport-McMoRan saw stock surges of nearly 5% following the announcement, signaling investor optimism about reshoring opportunities.

Strategic Calculus: Trade, Politics, and Global Reactions

Trump’s copper tariff is part of a broader push to reshape global supply chains and reduce the U.S. trade deficit. It follows similar levies on steel, aluminum, and auto parts, and comes amid rising tensions with BRICS nations and pharmaceutical exporters.

Key Strategic Motives:

- National Security: Copper’s role in defense and infrastructure makes it a critical mineral.

- Economic Sovereignty: Tariffs are designed to incentivize domestic production and job creation.

- Trade Leverage: The move pressures trading partners to negotiate bilateral deals or face steep duties.

Global Reactions:

- Chile, the world’s largest copper exporter, expressed concern but has yet to receive formal notification.

- Canada and Mexico, both under free trade agreements with the U.S., may seek exemptions.

- India, which exported $360 million worth of copper to the U.S. last year, is in active trade negotiations that could mitigate the impact.

Market Volatility:

- Comex copper futures surged over 12%, reaching record highs.

- LME prices dipped, reflecting global uncertainty.

- Manufacturers accelerated shipments to “front-run” the tariff deadline.

A Flashpoint in Commodity Politics

- President Trump’s 50% tariff on copper imports isn’t just a bold economic manoeuvre it’s a signal flare in an already tense global trade environment. While the policy aims to revitalize domestic production and bolster strategic autonomy in critical sectors, its ripple effects extend far beyond U.S. borders. Industries reliant on copper, from electric vehicles and clean energy to defense and electronics, are bracing for increased costs and supply chain disruptions.

- The real question is whether short-term protectionism will translate into long-term resilience or whether it will fracture trade alliances and slow innovation. For now, manufacturers are scrambling, markets are reacting, and world leaders are watching closely. Trump’s copper gamble may well reshape how commodities are weaponized in economic diplomacy.

Stay updated with the latest news on Rapido Updates. Keep yourself updated with The World, India News, Entertainment, Market, Automobile, Gadgets, Sports, and many more

Tariff Tremors: Jaishankar’s Calm Defiance Amid US 500% Sanctions Threat

India Strikes Back: Retaliatory Tariff Threat Sends Shockwaves Through US Trade Talks

2 thoughts on “50% Tariff Ignites Industry Panic and Global Trade Turbulence – Trump’s Copper Shockwave”