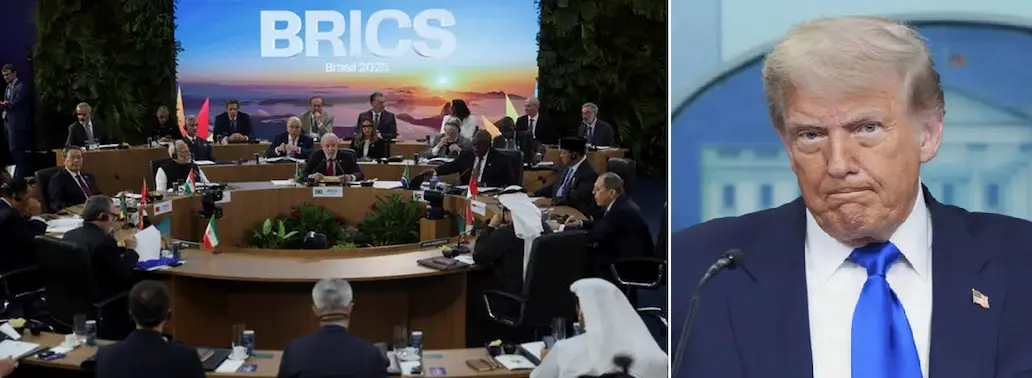

President Donald Trump threatens a sweeping 10% tariff on nations aligning with BRICS' “anti-American” policies, igniting fears of a global trade war

BRICS Rising: A Challenge to American Economic Supremacy

BRICS Allies -The 2025 BRICS Summit in Rio de Janeiro marked a turning point in global geopolitics. With ten member nations now under its umbrella, including Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, UAE, and Indonesia, the bloc represents 45% of the world’s population and contributes over 35% to global GDP. But it’s not just size that’s causing concern in Washington it’s intent.

BRICS leaders jointly condemned unilateral trade tariffs and criticized the West’s “double standards” on global conflicts, including recent US-Israel strikes on Iranian nuclear facilities. The bloc’s push for local currency trade, internal settlements, and a potential alternative reserve currency has been interpreted by many in the US as a direct challenge to dollar hegemony.

Trump, never one to shy away from confrontation, responded with a stark warning: any country aligning with BRICS’ “anti-American” policies will face an additional 10% tariff. He declared on Truth Social, “There will be no exceptions to this policy,” signaling a hardline stance that could reshape global trade dynamics.

Trump’s Tariff Gambit: Bluff or Economic Blitz?

Trump’s threat comes amid a broader resurgence of protectionist policies. Since returning to office, he has reinstated reciprocal tariffs and hinted at 100% duties for nations attempting to undermine the dollar. His administration has already issued tariff letters to 12 countries, though insiders suggest this may be a strategic bluff to test BRICS’ unity.

The timing is critical. The US dollar is at a three-year low, having declined over 10% against major currencies like the euro and yen. Trump’s tariffs, including a 26% levy on Indian imports, had taken effect in April but were temporarily reduced to 10% for 90 days. That suspension ends on July 9, with full rates expected to resume on August 1.

Treasury Secretary Scott Bessent warned, “If you don’t move things along, then on August 1 you will boomerang back to your April 2 tariff level”. The message is clear: align with BRICS, and face economic consequences.

Markets have already reacted. Metal prices tumbled, and fears of a broader trade war have rattled investors. The spectre of disrupted supply chains, reduced global trade, and recession looms large.

Global Reactions: Defiance, Diplomacy, and Strategic Calculus

BRICS nations have responded with cautious defiance. While they deny seeking to replace the dollar, they emphasize the need for inclusive globalization and economic efficiency. India, for instance, clarified that it does not “target” the dollar but seeks “workarounds” for trade partners lacking dollar reserves.

External Affairs Minister S. Jaishankar stated, “We have never actively targeted the dollar. That’s not part of our economic, political, or strategic policy”. Similarly, former RBI Governor Shaktikanta Das emphasized that India’s local currency agreements are meant to “de-risk” trade, not de-dollarize it.

Yet, Trump’s rhetoric has forced many nations to reassess their positions. Brazil, the summit host, has avoided controversial topics to escape tariff retaliation. Meanwhile, China and Russia continue to deepen their currency cooperation, viewing BRICS as a platform to counter Western sanctions.

The broader question remains: Is Trump’s tariff threat a tactical manoeuvre or the beginning of a full-blown economic war? With BRICS trade hitting $1 trillion in 2025 through local currency systems, the bloc’s influence is undeniable. But so is America’s ability to retaliate.

As the world watches this high-stakes standoff unfold, one thing is certain global trade will never be the same. Would you like me to visualize this with a comparative chart of BRICS vs G7 trade metrics or map out tariff impacts by region?

Stay updated with the latest news on Rapido Updates. Keep yourself updated with The World, India News, Entertainment, Market, Automobile, Gadgets, Sports, and many more

1 thought on “BRICS Allies – Trump Declares Ruthless Economic War Over ‘Anti-American’ Shift”